Charge-Out Rates

Flexibility to accommodate you and your practice is our key focus.

You can be based anywhere. Your charge-out rates may reflect your location, or you may simply want to offer a competitive rate. Whatever the reason, we don’t dictate your rates for your clients. You can choose what to charge for your time. You can utilise normal hourly or day rates, capped of fixed fees, or work on a retainer basis or, a combination of these can be included in our engagement letters.

There are no targets for Cadres Consultants.

Remuneration

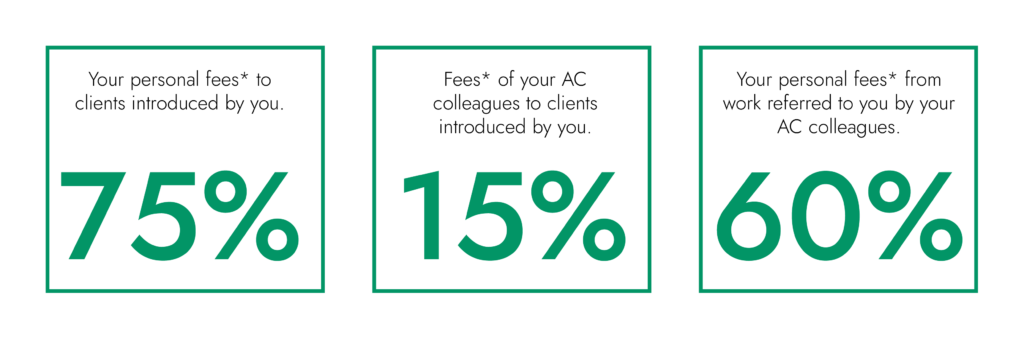

The Cadres Consult model is all about rewarding hard work and expertise and developing individual and firm-wide growth through connections, collaboration and teamwork.

We have a simple and generous fee structure. Each box below shows the percentage of the fees received which you will earn for work done by you and your Abbiss Cadres for clients introduced by you and the earnings you can expect for work introduced to you by us.

*Fees are net of disbursements and VAT

Get in touch

"*" indicates required fields