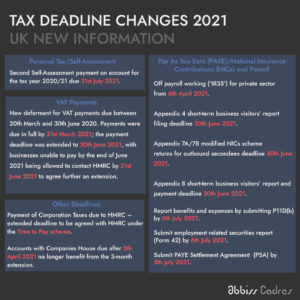

Year-end is a busy time for companies, especially when they are continuing to be impacted by the COVID-19 crisis, either directly or indirectly. HMRC recently updated some 2021 filing and payment deadlines to ease the burden on businesses.

Here we have outlined the changes to the 2021 tax deadlines that have been announced and we will update this list as and when HMRC issue new announcements:

- New deferment for VAT payments due between 20th March and 30th June 2020 deadline was extended to 30th June 2021.

- Appendix 4 short-term business visitors’ report filing extended to 30th June 2021.

- Appendix 7A/7B modified NICs scheme returns for outbound secondees extended to 30th June 2021.

- Appendix 8 short-term business visitors’ report and payment deadline extended to 30th June 2021.

- Payment of Corporation Taxes due to HMRC – extended deadline to be agreed with HMRC under the Time to Pay scheme.

Please get in touch if you have any questions or concerns about meeting your obligations:

Personal Tax/Self-Assessment:

Second self-assessment payment on account for the tax year 2020/21 due 31st July 2021.

VAT Payments

New deferment for VAT payments due between 20th March and 30th June 2020. Payments were due in full by 31st March 2021. The payment deadline was extended to 30th June 2021, with businesses unable to pay by the end of June 2021 being allowed to contact HMRC by 21st June 2021 to agree further an extension.

PAYE/NICs and Payroll

Off payroll (‘IR35’) for private sector workers from 6th April 2021.

Appendix 4 short-term business visitors report filing deadline 30th June 2021.

Appendix 7A/7B modified NICs scheme returns for outbound secondees deadline 30th June 2021.

Appendix 8 short-term business visitors’ report and payment deadline deadline 30th June 2021.

Report benefits and expenses by submitting P11D(b) by 6th July 2021.

Submit employment related securities report (Form 42) by 6th July 2021.

Submit PAYE Settlement Agreement (PSA) by 5th July 2021.

Other Deadlines

Payment of Corporation Taxes due to HMRC – extended deadline to be agreed with HMRC under the Time to Pay scheme.

Accounts with Companies House due after 5th April 2021 no longer benefit from the 3-month extension.

We will continue to update this page so that you can use this as a resource to support you in staying on top of your responsibilities and any changes.