The deadline is approaching for the HMRC’s annual return filings for the 2023/24 tax period. This will apply to companies in the UK, US and other countries that have share options and other share awards granted and acquired by UK employees for the tax year.

Understanding the reporting obligations is crucial to ensure your business remains compliant and avoids penalties. This comprehensive guide outlines the essential aspects of UK share plan reporting for 2024, with practical steps for effective reporting so you can efficiently manage your requirements.

Summary and 2024 share plan reporting deadline

The UK tax authorities’ (HMRC) submission deadline for annual return filings concerning employment-related securities for the 2023/24 tax year is midnight on 6 July 2024.

Employers that have any share plans or have had any share transactions involving UK employees or directors have an annual obligation to register any new reportable arrangements and file all relevant Employment Related Securities (ERS) returns. They must report any notifiable events concerning ERS.

Employers that operate international share plans will need to take additional care when filling their annual share plan returns as there are additional complexities to consider, particularly for internationally mobile employees.

The ERS reporting requirements apply to any share options, shares and other types of security that are acquired by UK employees by reason of their employment. It can therefore apply to stock options and other kinds of share incentives that are granted by non-UK companies to UK-based employees. Reporting may also be required in respect of non-UK resident employees who carry out work duties in the UK.

Reportable events

Reportable events are any events involving employment related securities (ERS) that the HMRC will need to be notified about on the annual return. These can include, but are not limited to:

- Grants of rights to acquire share or other securities

- Acquisitions of shares or other securities

- The lifting of restrictions (such as risk of forfeiture) from shares or other securities

Self-certification

Companies that introduce tax advantaged ERS plans, such as Share Incentive Plans (SIPs), Savings Related Share option plans (SAYE) and Company Share Option Plans (CSOPs) must self-certify online that the plan complies with the relevant statutory code.

The company secretary (or another person authorised to make the filing for the grantor company or UK subsidiary) should complete an online form declaring certain requirements have been met at the date of registration or from when the first option or award was granted.

Checklist and timeline for share plan registration and filing

Share plan reporting checklist

- Register all new share plans, schemes or arrangements on the HMRC online platform.

- If necessary, file a separate registration for one-off arrangements.

- Submit the relevant annual online return for each plan registered on the HMRC system.

- If there have been no reportable events in the reporting period, submit a nil return for all open tax-advantaged and non-tax advantaged plans.

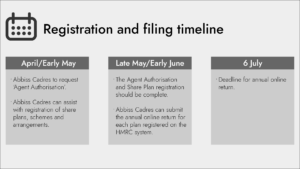

Share plan reporting timeline

New share plan registrations

Employers that have implemented new share plans will need to register these plans. Employers that have completed a corporate transaction involving the issue of new equity, rolled equity or loan notes will also need to register a new arrangement if the new rights granted or securities issued are not covered by an existing registration.

The employer must complete the plan registration on the HMRC online service. Agents can provide support and assistance but cannot themselves register plans on the HMRC system. At Abbiss Cadres, we offer webinars with training on registration or virtual ‘share-screen’ meetings where we can talk you through this process.

Once the share plan is registered, the employer will be provided with a unique reference number that is used to submit the annual return.

Employers should be aware that the tax benefits available for tax-advantaged share plans only apply where the relevant plan has been registered and self-certified.

Filing the annual share plan return

Step 1 – Agent Authorisation

Employers need to provide their nominated agent with their PAYE reference and accounts office reference number in order for the agent to request a code from HMRC.

HMRC will then send an authorisation code to the employer’s registered PAYE address by post.

The employer should then provide the agent with this code so they can gain access to the HMRC system.

This process can take up to four weeks, so it is very important that the employer starts this process early.

Step 2 – Plan Registration

Once agent authorisation has been completed, the authorised agent can submit the return on behalf of the employer (returns can be submitted from the 6th April 2024).

The employer should provide their agent with information on all awards of rights to acquire shares, all acquisition of shares, and all relevant vestings of awards in the previous tax year.

Common share plan reporting errors to avoid

Failing to include non-UK based employees

Employees that are non-UK based but have carried out duties in the UK during the period of award should be included in the filing.

Failing to include non-executive directors

Non-executive directors should be included in the ‘other’ return for non-tax advantaged plans.

Duplication or the incorrect registration of schemes

If you’ve already registered a scheme, you should select ‘view scheme arrangements’, and NOT ‘register a scheme or arrangement’. Doing the latter is a common error that causes duplication of the same scheme and can lead to unnecessary penalties.

Not filing in good time and failing to file nil returns

If there has been no share plan activity or ‘reportable events’ during the tax year 2023/2024, you must file a nil return. Failure to do so could result in penalties. The deadline for reporting Annual UK Share Plan filings is 6th July 2024.

Failing to correctly cease a scheme

To cease a scheme, select ‘view schemes and arrangements’, then select the relevant scheme and choose the option ‘End of year returns’. You must then select ‘provide a final date of event’ and enter the date. This can only be completed by the company and not an ERS agent.

ERS online access and uploading templates

You should not attempt to alter the template in any way. Any changes to the template, including adjusting the formatting, or deleting columns or tabs will prevent you from being able to upload the template to the gateway. You will receive an error message if this is the case.

Late notification of Enterprise Management Incentives (EMI) options

The grant of EMI options must be notified to HMRC within 92 days of the grant in order for the options to qualify as tax-advantaged EMI options. Where EMI options are granted under a new EMI plan, the employer must ensure that the EMI plan is registered in good time for the notification of grant to be filed within the 92-day period. HMRC can take up to 10 days to approve a scheme registration, and so the registration process should be started well before the end of the notification period.

Penalties for late filing

If returns are filed after the deadline (6 July 2024), penalties may be imposed, and any tax advantages from a tax-advantaged plan for employers and employees may be lost. It is therefore important to start making the necessary preparations for annual returns compliance.

Filed after 6th July 2024

£100 penalty for each outstanding return.

Filed 3 months after the 6th July 2024

£300 additional penalty for each outstanding return (total of £400 per return).

Filed 6 months after the 6th July 2024

£300 additional penalty for each outstanding return (total of £700 per return).

Filed 9 months after the 6th July 2024

£10 additional penalty per day for each outstanding return.

How Abbiss Cadres can help with your share plan reporting

Abbiss Cadres can provide advice and guidance in relation to all aspects of the annual reporting requirements. We can assist you with a seamless reporting process including:

- Practical support with registrations;

- Help with self-certification of tax advantaged plans;

- A review of your current reporting processes and how to format your report correctly to comply with the HMRC system;

- Preparation and return of all filings;

- Expert advice on tax treatments and administration of all share plans; and

- Assessment and advice on data protection compliance in relation to share plan reporting.

For further information on how we can help please get in touch.